Categories

ATO Scam Alert for myID

At Paris Financial, your security is our priority. We want to alert you to the latest scams targeting taxpayers and provide tips to safeguard your personal and financial information.

Latest ATO Scam Alert for myID

The ATO has reported new scams involving impersonation through emails, phone calls, and text messages. These scams attempt to steal personal identifying information and access accounts. Below are the key details to help you identify and protect yourself against such fraud:

Scam Examples

- Email Scam

- Scammers, posing as the ATO or myGov, are claiming taxable incomes have been recalculated, promising compensation in exchange for personal information.

- Requested details include payslips, TFNs, driver’s licences, and Medicare details.

- These details can be used for identity theft, refund fraud, or to access your superannuation.

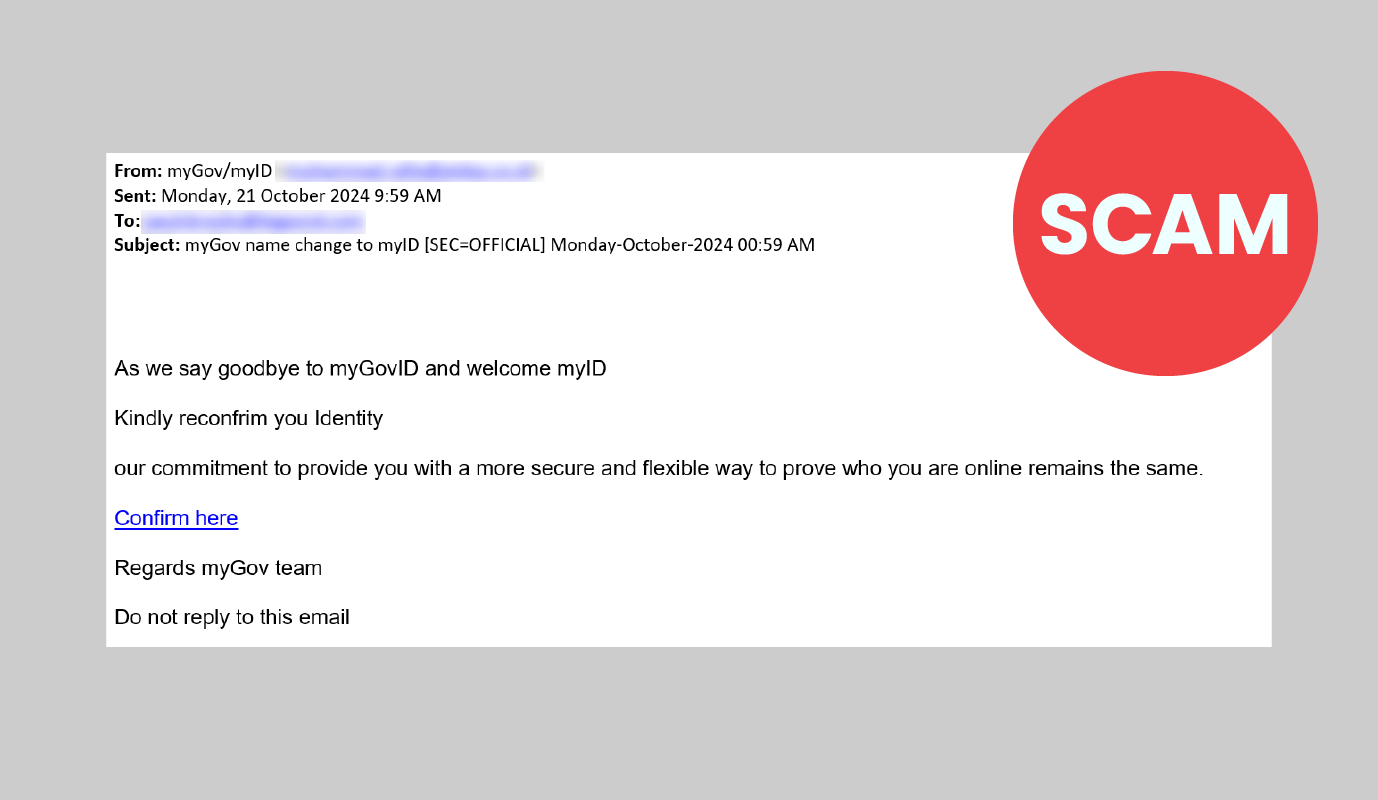

- myGovID to myID Scam

Fact: myGovID has changed its name to myID. You don’t need to do anything for this change like setting up a new myID or re-confirming your details. But, if you’re asked to do this, it’s a scam.

- Scammers are exploiting the name change of myGovID to myID, occurring mid-November 2024.

- They may send fake emails requesting you to reconfirm your details via fraudulent links.

-

- These links direct you to fake myGov sign-in pages to steal credentials.

Find out more at: www.myID.gov.au/DiscovermyID

How to Stay Safe

- Do not engage with emails, calls, or SMS claiming to be from the ATO unless you are sure they are legitimate.

- Always access services directly by typing ato.gov.au or my.gov.au into your browser.

- Never provide personal identifying information like TFNs or driver’s licence numbers via unsolicited requests.

- Verify suspicious interactions by calling the ATO directly at 1800 008 540 or visiting the ATO’s official Verify or report a scam

- Only download the myID app (formerly myGovID) from trusted app stores (Google Play or the App Store).

Key Reminders

- The ATO will never send SMS or emails with links to log on to online services.

- Unsolicited messages asking for personal information are always a scam.

- Avoid clicking on links, opening attachments, or downloading files from suspicious emails or SMS.

- The ATO will not use social media platforms to discuss personal information, send payment requests, or provide links.

The following image is one example of the format this scam can take.

We encourage you to remain vigilant and stay informed about these scams to protect yourself and your business.

For further scam alerts, visit the ATO website or contact the ATO directly.

Stay safe!