Categories

Investment Loan

Warning: Redrawing investment loans

Discover the tax complexities of redrawing investment loans. This article sheds light on ATO’s scrutiny and the need for correct reporting.

... read moreUtilising Redraw For Your Investment Property

My client, let’s call her Rachel, is planning on moving into this property for one to two years and renovating it during that time, before moving on to her next property and renting this one out. There are many things to think about when getting a mortgage but I am only going to look at the potential tax effects of different loan structures.

... read moreOffset VS Redraw For Property Investors

It's a tricky decision for many, so our property expert has given some advice on what will be best for you.

... read moreANZ Lending Update

Effective 16 June, ANZ Bank will increase their Variable Interest Only home loan rates for both investors and owner occupiers by 30 basis points. ANZ's Standard Variable Rate for investment lending with Interest Only repayments is now 6.26% p.a..

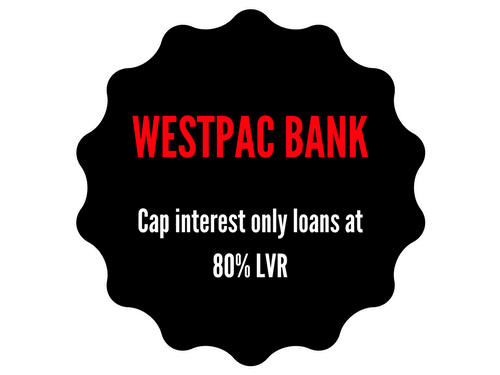

... read moreLast of the Major 4 Banks to cap interest only loans at 80% LVR

Westpac Bank announced today the maximum LVR (loan to valuation ratio) for those seeking interest only repayments will be capped at 80%. This applies to both owner occupied and investment lending. They are last of the Major 4 Banks to cap LVRs for ...

... read moreOvercapitalising – what it is and how to avoid it

As a home owner or property investor, you may have heard the term ‘overcapitalising’. But what exactly is it and why is it considered bad?

... read moreYour guide to investment property loans

There are certain things to look out for when selecting and applying for a loan for your investment property. Here we look at the main differences, the most popular loan types, and how to get the best mortgage for your situation.

... read moreCash rate remains at 1.50% and lending polices are expected to further tighten

The RBA has again left interest rates on hold at the historical low of 1.50%. There has been no changes to the cash rate since August 2016. However over the past few weeks out of cycle rate hikes by the major banks and second tier lenders have made front page headlines. These interest rate increases ranged from negligible increases to owner occupied loans to smacking investors and those whose loans feature interest only repayments with some significant increases.

... read more