Categories

Navigating market volatility

Financial markets have been erratic lately, understandably causing some concern for those of us with super and investments. While dips and major market events are a common feature of investing, markets generally trend upwards over time.

Most super funds invest in sharemarkets to help your money grow over in the long term. So when markets see-saw, so do super and investment balances and returns.

While this can be worrying, it’s important to remember that although the value of investments may go up and down at different times, markets tend to recover and grow over the long term. So it’s important to keep your long-term investment goals in mind.

What’s happened recently?

On 3 April, President Donald Trump announced the US would place tariffs on goods imported into the US from countries around the world. This included a 10% tariff on goods from Australia, which was the minimum rate announced on the day.

Major global economies and markets had been preparing for the announcements, but the tariffs imposed on some countries were bigger than expected. Other countries have also responded by putting similar tariffs on US goods coming into their markets.

As a result, share markets in the US and elsewhere fell sharply in the days afterwards, including the Australian Stock Exchange.

What is a tariff?

A tariff is a tax added to the cost of goods imported from a particular country or countries. It is paid to the government where the goods are being imported.

Tariffs are often used to protect domestic industries by increasing the price of foreign-made competitor products, or to raise revenue.

The cost of those items to the public will generally increase by a similar amount to the tariff.

What does this mean for markets and investments?

The US tariffs are expected to slow global trade and push up the price of some things, which could cause inflation to rise.

This could result in the Reserve Bank of Australia cutting the interest rate several times this year to prevent the economy from slowing down too much.

In the short term, you may see a negative effect on the performance of investments.

Short term volatility in response to political announcements and other geopolitical events is a common feature of investment markets.

While difficult to forecast, history shows us that markets do recover from disruptive influences – for example, from the Global Financial Crisis and the COVID-19 pandemic.

What led to this?

Since Trump’s second presidency began, uncertainty has emerged about US policy in the areas of tariffs, defence and other critical areas of government spending.

In recent months, shares have been quite weak, particularly US technology stocks. This group of stocks was optimistically priced after two years of strong growth, and therefore most at risk of uncertainty in the US market.

This has unsettled businesses amid concerns the US economy could slow. It has also fed into uncertainty in global investment markets, including the Australian sharemarket.

What does this mean for me?

As global financial markets move up and down, the value and returns of your super and investments may also change in the short term.

While this can be concerning, history shows that markets rise over time. So it’s important to keep your long-term savings and investment goals in mind and carefully consider before making any changes to your investment strategy.

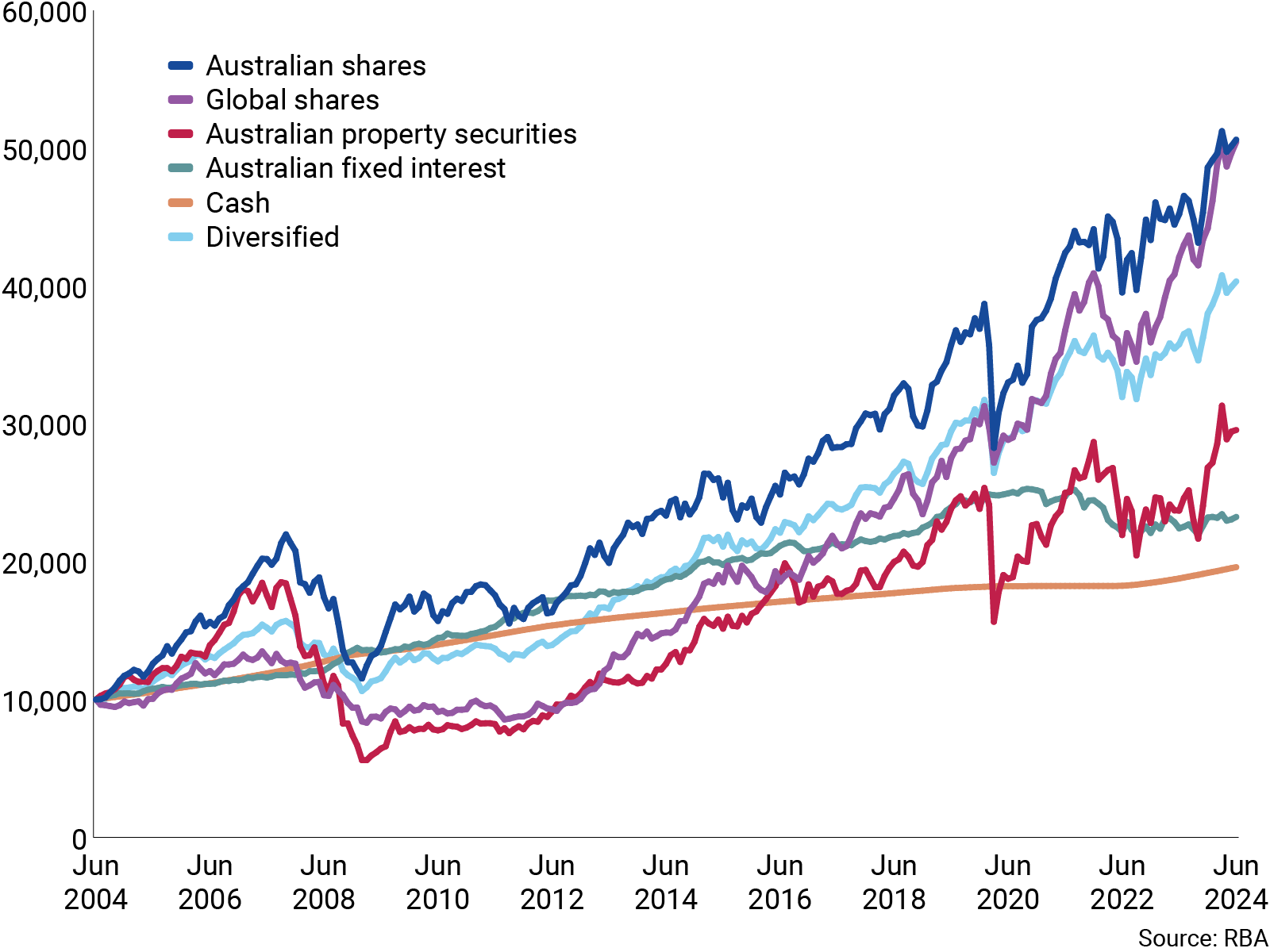

It’s understandable at times like these that some members think about changing how their money is invested. As this chart shows, the long-term trend across major investment types is positive, with shares experiencing more volatility but generating higher returns than more conservative options such as cash.

While past performance is not a guarantee of future performance, historically more time invested in the sharemarket has meant a higher return on investment.

How different investment types have performed over 20 years

It’s also worth noting that investment performance has generally been strong over the past two years, meaning the value of your investments or super may have been relatively high.

Do I need to do anything?

As with any significant market event, it’s best to avoid impulse reactions, but to take a long-term view.

Navigating market volatility doesn’t have to feel overwhelming. Talk to Paris Financial about how navigating market volatility fits into your long-term investment strategy.

Source: CFS