Categories

Poorly Structured

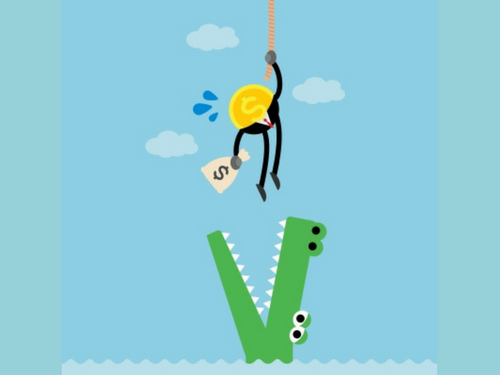

I heard a horror story the other day about poor structuring. Let’s just call this person Wayne Structureless for simplicity. Wayne has shares in a very profitable small business in his own name. The Business is structured as a company and Wayne is a one third Partner. Wayne has his three investment properties in another company structure with himself and his wife owning all the shares. His Principal Place of Residence is in Joint Names.

This is disaster, disaster, disaster because Wayne’s business has a lawsuit against it for more money than their insurance can payout. So if the lawsuit attacks the excess assets in the company and that is still not enough, Wayne had better be certain that he’s done the right thing in other aspects as a company director. The ability to be financially protected by the limited liability of the Company is also being eroded every year with cases attacking Directors personally.

Now Wayne is 68 years of age and has his investment properties, his house and his hard earned personal wealth at stake due to poor structuring that offers very little capital protection.

We see disaster stories of poorly structured business people like Wayne on a regular basis in public practice and we are at pains to tell people to follow the 3 golden rules…

- Have your PPOR in the non-working Director’s name in your personal relationship

- Structure trading entities and investment entities as trusts with corporate trustees NOT as companies or in personal names

- Never, ever, ever buy a Capital Growth asset in the name of the working Director

Simple stuff but Wayne is not the exception out there, unfortunately his poorly structured financial setup is all too common.

Pat Mannix, Partner, Paris Financial

Follow me on Twitter @mannix_pat

Image courtesy of paggiest0049 at FreeDigitalPhotos.net