Categories

Business

Poorly Structured

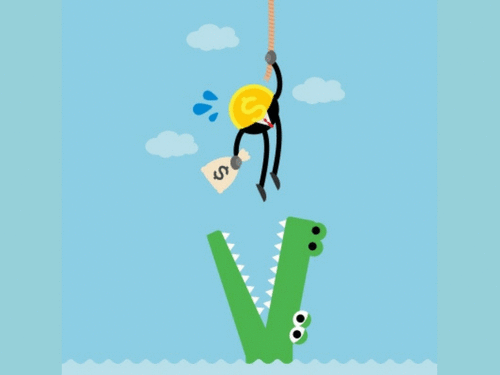

I heard a horror story the other day about poor structuring. Let’s just call this person Wayne Structureless for simplicity. Wayne has shares in a very profitable small business in his own name.

... read moreWhat’s involved in selling your business?

Selling your business can be a stressful time and unless you’ve done it before, it’s hard to know what to expect or what’s required to get the right result. We’ve put together the top issues for business owners or investors to maximise their results.

... read moreStructuring for Partners with Disproportionate Ownership

Disproportionate ownership of business’s is not uncommon, and the correct structuring for your business is critical in ensuring maximum tax benefits, flexibility for distributions, income tax and capital gains, not to mention long term asset protection for all the Partners involved.

... read moreGrowing Businesses – increase your super and save tax

Retirement and superannuation are always a topic of conversation for our small business clients. Paris Financial are pro-active in our approach with our small business owners and through discussion and planning we can advise our clients on how they can utilise the small business “retirement exemption” to make up to $500,000 in additional superannuation contributions and also save on tax.

... read moreGreat news for business people stuck in company structures!

The Government has introduced the “Tax Laws Amendment (Small Business Restructure Roll-over) Bill 2016”.

What does this mean for me?

It’s fantastic news for business owners who have been set-up in a dreaded company structure, at present this structure can be extremely difficult to transfer out of, due to capital gains tax (CGT) implications.

... read more