Categories

Latest News

Compare principal and interest and interest-only home loans

Finding out which home loan is right for you depends on your personal situation. Are you looking for a home loan to buy your first home, update your current one or as an investment in retirement? Are you confused by all the jargon and what type of home loan is right for you? We delve into two of the most popular home loans: principal and interest and interest-only.

... read moreMillions but not all to benefit from 2017 super changes

With changes to super now in effect, numerous Australians will get a leg up, many being low-income earners. According to the Association of Superannuation Funds of Australia (ASFA), more than four million Australians will benefit from the super changes that came into effect on 1 July 2017.

... read moreDeath and small business CGT concessions

When a person dies, their assets are transferred to their legal personal representative (LPR) or are acquired by a surviving joint tenant, where the deceased owned those assets as joint tenants with another person. As there is a change of ownership a capital gains tax (CGT) event arises.

... read moreWhat is a 'Cryptocurrency'

A cryptocurrency is a digital or virtual currency that uses cryptography or encryption for security. A cryptocurrency is difficult to counterfeit because of this security feature. A defining feature of a cryptocurrency, and arguably its most endearing allure, is its organic nature; it is not issued by any central authority, rendering it theoretically immune to government interference or manipulation.

... read moreProperty Inheritance – CGT & Property Sales

In my previous article I mentioned that if you inherit a dwelling and later sell or otherwise dispose of it, you may be exempt from capital gains tax (CGT), depending on when the deceased acquired the property, when they died and whether the property has been used to produce income (such as rent).

... read moreInnovative investor incentives

If your innovative idea has real legs for commercialisation in business then the government has set up a tremendous incentive for venture capitalist investors. It’s a sign our politicians are wanting to support the innovation of entrepreneurial Australians and it’s also an indication of the global vision of these entrepreneurs.

... read moreHow your bank calculates a business risk

Just like you, banks are in business – and they don’t succeed by making bad deals. When they consider your loan application, they’re calculating the financial risk of entering into an arrangement with you. Let’s break it down...

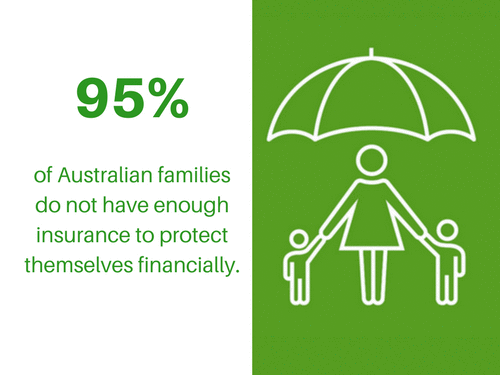

... read moreWhat happens if I let my insurance lapse?

Think about where you would be without insurance if something were to happen to you. If you let your insurance cover slip, you risk being unable to make a claim when you may really need to.

... read more