Categories

Archive for category: Strategic Financial Advice

Latest News

Travel tips to help you spend less on your next holiday

It’s that time of year again when it feels as though everyone you know is escaping winter to head off across the world on a fabulous holiday (and sharing many photos to prove it). Whether you’re about to head off on a travelling adventure yourself, or your planning is still in the dreaming stage, take note of these tips to ensure your hard earned break is as stress free as possible.

... read moreSuper savings for your first home

Let’s face it, getting your foot on the first rung of the property ladder is not only hard, for an increasing number of younger Australians, it’s downright impossible. As housing prices, particularly in capital cities, continue to outstrip wages growth, even saving for a deposit to buy a house can seem all too hard. It’s a bit like taking one step forward and two steps back, right?

... read moreDon't be driven by short-term sentiment and emotion

Arguably, the most common fear holding an investor back from achieving a great return is a misunderstanding of what happens when markets fall (as they invariably do). In order to use fear to our advantage, we would be well served to seek to understand the following three principles around shares and their value ...

... read moreStaying safe online

Financial cybercrime is on the rise in Australia, as the increasing use of technology such as online banking and social media makes it an attractive target for criminals. Despite increasingly sophisticated methods being used, there are a number of things you can do to help you and your family stay safe online.

... read moreCompare principal and interest and interest-only home loans

Finding out which home loan is right for you depends on your personal situation. Are you looking for a home loan to buy your first home, update your current one or as an investment in retirement? Are you confused by all the jargon and what type of home loan is right for you? We delve into two of the most popular home loans: principal and interest and interest-only.

... read moreMillions but not all to benefit from 2017 super changes

With changes to super now in effect, numerous Australians will get a leg up, many being low-income earners. According to the Association of Superannuation Funds of Australia (ASFA), more than four million Australians will benefit from the super changes that came into effect on 1 July 2017.

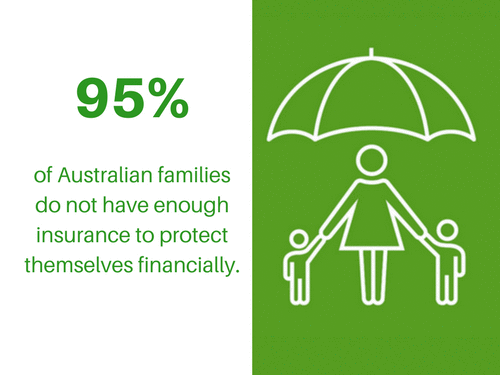

... read moreWhat happens if I let my insurance lapse?

Think about where you would be without insurance if something were to happen to you. If you let your insurance cover slip, you risk being unable to make a claim when you may really need to.

... read moreWhether your goal is to pay off your mortgage or holiday each year, you are more likely to succeed with a plan of action!

If you’ve paid off your home, have a healthy stash of super and take an overseas holiday each year, you’ve made it financially. That’s the view of many Australians according to recent research.

... read more