Categories

Latest News

Is it worth salary sacrificing into super?

Salary sacrificing into super can be a smart way to enhance retirement savings and reduce taxable income. This article explores the benefits and considerations to determine if it’s worth it for you.

... read moreThe rise in business bankruptcy

Business bankruptcy rates are climbing in 2024, with industries like construction and food services hit hardest. Understand the warning signs and how to manage your business’s financial health.

... read moreDivorce, you, and your business

Divorce and business often intersect in complex ways. This article delves into the financial implications of divorce for business owners, exploring how family companies, superannuation, and assets are handled during marital dissolution.

... read moreAllied Health Accountants Are Crucial For Your Practice’s Success

Discover how specialised allied health accountants can transform your practice. From navigating complex regulations to optimising finances, learn why expert financial management is crucial for your success. Focus on patient care while we handle the numbers.

... read moreIs your family home really tax free?

“Is my home tax free?” It’s a common question for Australian homeowners. This article delves into the complexities of the main residence exemption, explaining when your family home might be subject to capital gains tax and how to navigate the rules.

... read moreHow to Reduce Capital Gains Tax: 5 Strategies for Australians

Learn how to use capital losses, choose the right gains to offset, and time your asset sales strategically. This guide covers everything from basic CGT concepts to advanced tax-saving techniques for investors and small business owners.

... read moreSharing Economy Platform Income – ATO’s New Reporting Rules

New ATO rules for sharing economy platforms affect your tax return. Learn how this reporting regime impacts income declaration from Airbnb, Uber, and more.

... read moreWhat’s ahead for 2024-25? Tax, Wages, and Business Trends

What’s ahead for 2024-25? This article delves into tax changes, wage adjustments, and business trends, helping you navigate the year ahead effectively.

... read more$20k instant asset write-off passes Parliament

Explore the $20k instant asset write-off for 2024 and learn how small businesses can leverage this tax benefit for eligible asset purchases, enhancing cash flow.

... read moreWork Clothing Deductions for 2023-24

Find out how to handle work clothes deductions for the 2023-2024 tax year. We’ll show you what you can and can’t claim so you can get the most out of your tax refund with our easy-to-follow guide.

... read moreThe essential 30 June guide

The essential 30 June guide highlights key opportunities to maximise deductions and outlines risks to avoid ATO scrutiny. Learn how to bring forward deductible expenses, bolster superannuation, make charitable donations, and ensure compliance with tax regulations.

... read moreATO fires warning shot on trust distributions

The ATO has issued a warning about trust distributions, urging trustees to review and comply with their trust deeds. Learn the key areas of concern and how to avoid penalties by ensuring your trust distributions are valid and properly managed.

... read moreWhat’s changing on 1 July 2024? Major updates & benefits

Explore the significant changes coming on 1 July 2024, including personal tax cuts, superannuation increases, and energy relief credits for households and businesses. Stay informed on how these updates will impact you.

... read moreAccessing money in your SMSF

Discover the risks and regulations around accessing money in your SMSF. Understand how to avoid illegal schemes and ensure your superannuation stays secure and compliant with ATO guidelines.

... read moreOutliving your savings

Concerned about outliving your savings? Discover essential tips to ensure your retirement income lasts as long as you do. Learn how to plan effectively with superannuation, Age Pension, and lifetime annuities.

... read moreHow much is my business worth?

We often hear ‘How much is my business worth?’ Explore factors that define your business’s value and ways to increase it effectively.

... read more2024-25 Budget Breakdown: How It Affects You and Your Wallet

Dive into the Budget 2024-25 with our comprehensive breakdown. From tax cuts to energy bill relief, find out what’s in store and how it directly impacts your finances.

... read moreMay 2024 Economic and market overview

Discover the latest trends and insights in our May 2024 economic and market overview. Learn about global growth forecasts, inflation, interest rates, and market performance across major regions.

... read moreSeven lasting impacts from the COVID pandemic

Discover how the COVID pandemic has led to bigger government, tighter labor markets, reduced globalisation, higher inflation, worse housing affordability, the rise of working from home, and a faster embrace of technology.

... read moreMillions to get more Age Pension starting from 20 March 2024

From 20 March 2024, millions of eligible Australians will see an increase in their Age Pension payments. Discover how these changes help address inflation and cost of living.

... read moreWhat is risk appetite?

Risk appetite defines your willingness to accept potential losses for investment gains. Discover how understanding your risk profile can guide your financial decisions and help achieve your investment goals

... read moreThe First Home Super Saver Scheme (FHSSS): a handy guide for homebuyers

Discover how the First Home Super Saver Scheme can help you save for your first home. Learn about eligibility, contributions, and the tax benefits that make home ownership more achievable.

... read moreWhy it’s time to consider currency hedging your portfolio

Discover the benefits of protecting overseas investments with hedging. Learn how currency hedging can offset foreign exchange risks and improve the stability of your global investment returns.

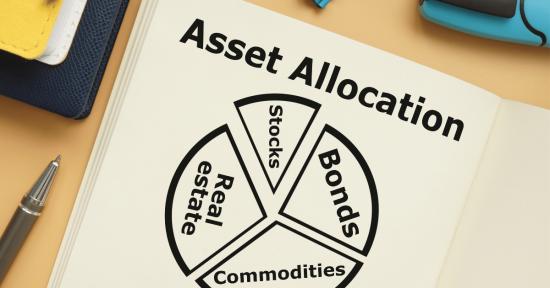

... read moreWill cash remain king?

Discover why it’s essential to reassess your asset allocation. While cash has been a top performer, changing interest rates and inflation trends suggest it might be time to consider bonds for long-term growth.

... read moreAre bonds a good investment?

Considering bonds for your portfolio? Discover the benefits and risks of bond investments and how interest rates impact their value. Learn why bonds can be a stable income source and help diversify your investments.

... read more